Sectors we have covered:

Hotel and Tourism Part I – Tourism: an Economic Generator & Infrastructure Constraints

Hotel and Tourism Part II – Challenges, Government Support & Outlook

Banking & Finance – The Economic Driver, Challenges, Opportunities & Forecast

Telecommunications – More than Just Talk-time, Challenges, Opportunities & Outlook

Transportation – Better Transport to Boost Economic Growth, Challenges, Opportunities & Outlook

Retail – Myanmar’s Economy Fueling the Retail Boom, Challenges, Opportunities & Outlook

Education – Educating Myanmar’s Future, Challenges, Opportunities & Outlook

A Look into Myanmar’s Services Sector: Oil & Gas

Myanmar is one of the world’s oldest oil producers. The country exported its first barrel of crude in 1854. Despite this, its upstream sector is still not mature. This is due to a number of factors; sanctions, government policy and insufficient investments have all hindered Myanmar’s efforts to realize its Oil & Gas (O&G) potential.

Myanmar’s Best Prospect Industry Sector

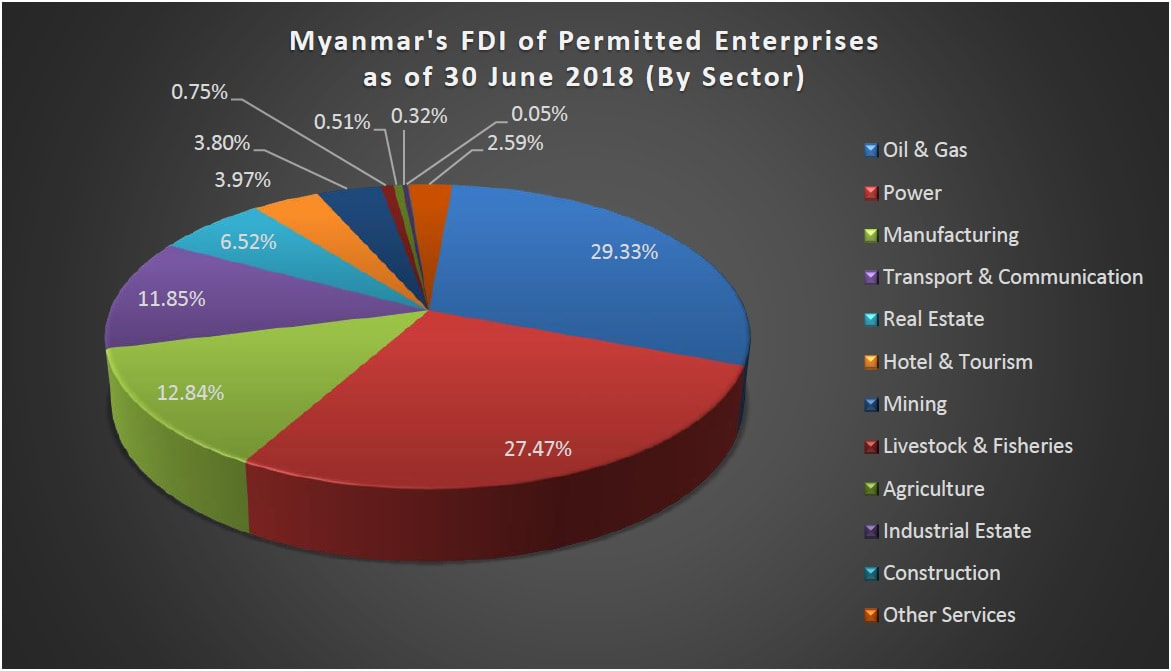

As of June 2018, the country O&G sector has attracted over US$22.4 billion in foreign direct investments (FDI), which accounts for 29% of the total FDI from 154 permitted foreign enterprises. This makes the sector one of the top sectors for FDI in the country.

The Ministry of Electricity and Energy (MoEE) is the principal government body responsible for regulating oil exploration and production activities in Myanmar. However within the MoEE, the following entities are influential in energy projects: the Oil and Gas Planning Department (OGPD) which is responsible for negotiating production-sharing contracts (PSC) with foreign oil companies and Myanmar Oil and Gas Enterprise (MOGE) which is responsible for the exploration & production (E&P) of petroleum within Myanmar and has exclusive rights to carry out all O&G operations with private contractors. MOGE is the oil operator, service provider and regulator of the O&G sector in Myanmar. It also oversees two other entities which are Myanma Petroleum Enterprise (MPE), responsible for O&G exploration and production and domestic gas transmission and Myanma Petroleum Products Enterprises (MPPE), which manages retail and wholesale distribution of petroleum products. The above-mentioned MOGE, MPE and MPPE are the main buyers in the O&G sector are responsible for issuing tenders to foreign companies. Clearly the levels of regulatory body that any foreign investor interested in this sector will have to go through may already prove to be too much.

Myanmar’s current energy needs are supplied by oil, gas and hydro. The country’s daily consumption of oil is estimated to be approximately 29,000bbl/d, which is more than the amount it produces which is at approximately 11,866bbl/d. It is evident that Myanmar will be increasingly dependent on its oil imports over the short term. However with the completion or supporting O&G infrastructure such as refining facilities and pipelines, the country will rely on its crude oil import to satisfy its domestic needs, and eventually turn to exporting refined O&G products.

Challenges

While there is much optimism about Myanmar’s potential O&G reserves, there is still a certain degree of uncertainty. As highlighted earlier in this blog post, the challenges in entering into Myanmar O&G market is related to its current infrastructure and factors that lie within the government’s regulatory bodies. Further exploration may unveil much more reserves, however currently the country’s O&G market still lacks both the human and physical capacity to support its domestic needs.

The volatile and unclear legal system also poses a challenge to foreign investors, as O&G projects are typically investment heavy commitments. This is further contributed by the lack of coordination between the country’s multitudes of O&G related ministries. Foreign investors should be aware that the number of government entities required to review and approve the O&G related investments are extensive and includes: the MOGE, Ministry of National Planning and Economic Development, Ministry of Finance, Myanmar investment Commission, and the Ministry of Environmental Conversation and Forestry.

Distribution also poses another challenge for both the Myanmar government and investors. Although O&G projects may have secured the necessary capital, for any project to be successful, they must develop and execute appropriate strategies reaching out to the various stakeholders.

Although Myanmar’s O&G sector still poses many challenges, recent political and economic development combined with the country’s abundance of natural resources make Myanmar one of the most promising small markets for upstream exports.

Opportunities

Myanmar’s O&G sector will continue to grow and investment opportunities are emerging on the back of a string of changes and restructuring efforts currently underway in the sector. Domestic demand for O&G will increase with economic growth.

The MoEE is currently reviewing the terms and conditions of the country’s existing O&G PSC to make it more attractive to investors. The ministry aims to create a win-win result for the government and investors if the O&G exploration and production in Myanmar. The current PSCs are based on situations in the market decades ago, and the government is looking to make it more accommodating and flexible to investors. PSCs will be redrawn to attract and retain investors in the O&G sector.

There lies a huge potential in Myanmar’s offshore blocks, as around 70% of it remains unexplored. Should O&G be discovered there, it will be monumental for the region. With the expected recovery of oil prices from 2018 onwards, it will lead to a spike in offshore sector investments. Currently, there are 54 onshore O&G blocks in Myanmar, of which production works have been carried out in 25 by the government in cooperation with foreign ventures. The MOGE is producing from another 11 blocks, leaving and remaining 18 unoccupied.

Outlook

The prospects of Myanmar’s O&G sector is tremendous because of an increase in exploration activity is expected with requirements from the technical knowledge in seismic and drilling solutions to service. The sector is in its infancy stages, thus expertise in areas such as infrastructure, logistics, regulation, compliance and insurance are in high demand. Should the potential of Myanmar’s O&G sector be fully harnessed and developed properly, it will consequently bring the much needed wealth to its people and investors, and Myanmar may just be the regional O&G hub.

----------

Editor’s Note: For those who have missed out on the sector(s) we’ve covered previously, click below to read:

Hotel and Tourism Part I – Tourism: an Economic Generator & Infrastructure Constraints

Hotel and Tourism Part II – Challenges, Government Support & Outlook

Banking & Finance – The Economic Driver, Challenges, Opportunities & Forecast

Telecommunications – More than Just Talk-time, Challenges, Opportunities & Outlook

Transportation – Better Transport to Boost Economic Growth, Challenges, Opportunities & Outlook

Retail – Myanmar’s Economy Fueling the Retail Boom, Challenges, Opportunities & Outlook

Education – Educating Myanmar’s Future, Challenges, Opportunities & Outlook