Sectors we have covered:

Hotels and Tourism Part I – Tourism: an Economic Generator & Infrastructure Constraints

Hotels and Tourism Part II – Opportunities, Government Support & Outlook

Banking and Finance – The Economic Driver, Challenges, Opportunities and Forecast

Telecommunications - More than Just Talk-time, Challenges, Opportunities & Outlook

Transportation - Better Transport to Boost Economic Growth, Challenges, Opportunities and Outlook

A Look into Myanmar's Services Sector: Retail

Myanmar’s retail sector promises a significant potential. Having recently opened up its economy and with consumers anticipating major changes and new opportunities, this is a country with enormous market potential. City Mart; one of the country’s largest retailers have announced expansion plans which include doubling the number of its supermarkets, tripling the number of its convenience stores and embarking on eCommerce with a click-and-collect service.

As Myanmar’s economy becomes more robust, growth is expected to continue in line with unwavering investor interest, therefore the retail sector is likely to see further expansion. Evidently so as the amount of leasable retail space grew by 19% as of Q1 2017, with most of the retailers targeting low-midrange consumers. Junction City Shopping Centre is the latest addition to the retail mall scene in town. It is one of the largest malls in the city with about 40,000 sqm of leasable space. With upcoming projects being mostly integrated mixed-use developments, the quality of Myanmar’s retail landscape seems promising.

Demand for retail space is expected to grow. Majority of retail spaces are leased by food & beverages, clothing and footwear tenants, of which some are represented by foreign brands. Such presence of international brands, gives local businesses added confidence in spite of the rise of influences and attraction toward global brands.

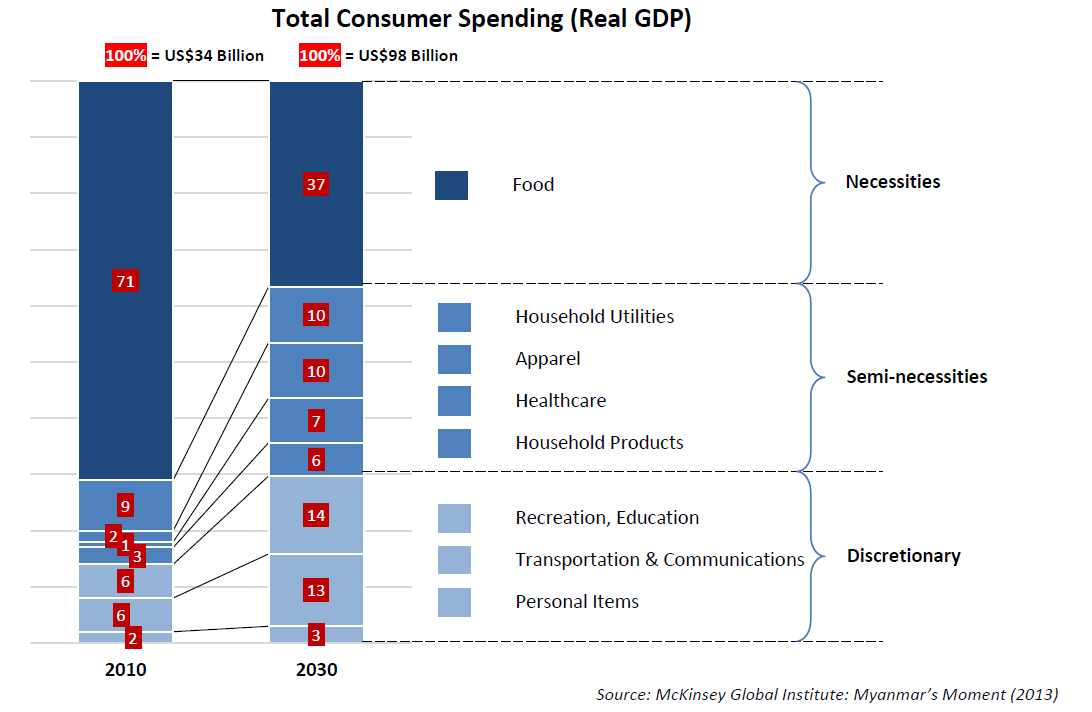

The rise in retail spending is a natural reaction to growing income and wealth. The size of middle class especially has expanded with many consumers coming out of poverty due to strong economic growth. This clearly shown in the chart below. Myanmar’s consumers are becoming more affluent and with a relatively large and young population that is moving fast to city centers – where spending avenues are abundant – herein lies the contributing factors in Myanmar’s retail landscape.

Previously shoppers who can afford luxury goods would usually make purchases online or head over to Singapore, Thailand or Europe. But that will soon change as more luxury brands are eyeing on future sales here. Demand for luxury retail is attributed not only from the existing elites, but also from the rising middle class and Myanmar emigres coming home in pursuit of business opportunities.

Myanmar’s retail challenges lie mainly in its under-developed infrastructure wherein affects the retail distribution supply chain. Hence why the retail landscape is still predominantly traditional based, with most retail distribution channels including wet markets, traditional convenience stores, general grocery stores, kiosk or hawkers. Many of the aforementioned sell items for immediate needs/consumption such as food and beverage items, confectioneries and fast-moving consumer goods (FMCG). In addition, majority of the stores are located in urban area making retail distribution limited to city centers. So why are there not many retail stores outside the city areas? Many retailers cite high costs in finding suitable sites to develop or convert into shops.

Another challenge that Myanmar faces is finding appropriate platforms for eCommerce. As the country develops, the platform needs to be robust enough against the onslaught of web marketplaces and social media sites. As it is some companies are finding that a lack of relevant infrastructure is making for a slow beginning to their frontier ambitions. In addition to that, the people’s trust in in online shopping is also a challenge, therefore online retailers will need to show high quality products at reasonable prices, or even consider holding demos to gain consumer confidence.

Opportunities

Big foreign brands are already available in Myanmar such as Nestle, P&G, Pepsi and Coca-Cola. Local partners have showed enthusiasm to partner foreign firms with the believe that they can grow rapidly as they expand the varieties of products available to domestic consumers.

Demand for a wider variety of grocery products, personal care products, household products, processed foods, alcoholic and non-alcoholic drinks, etc have also seen an increase as with the changing lifestyle of consumers, who are becoming more affluent. As the society becomes more health conscious and their consumer income increase, demand for organic food and products have also increased.

International F&B brands, new designs and technologies are transforming Yangon’s retail scene. Their presence define trends, shifting towards trendier concepts, and offering a wider variety of product offerings which will be essential for retail developments going forward. Generally consumers are strongly embracing these new experiences. The shift in consumer preference towards modern retail developments is creating a strong reason for expansion especially in the short term. Future developments can start considering integrating entertainment facilities and indoor activities as part of their offerings; which could be a driver to generate stronger consumer traffic.

Outlook

The middle class population in Myanmar are getting more affluent and their incomes have been rapidly increasing. As a result, the country now offers a growing market for foreign consumer goods companies looking to diversify their market portfolio. The Burmese retail sector has seen a large number of foreign brands entering the market and it’s only expected to increase over time. However the consumer buying power will continue to reign within the capital city of Yangon, but there remains a widely untapped demand in the rest of country.

----------

Editor’s Note: For those who have missed out on the other services sectors, click below to read:

Hotels and Tourism Part I – Tourism: an Economic Generator & Infrastructure Constraints

Hotels and Tourism Part II – Opportunities, Government Support & Outlook

Banking and Finance – The Economic Driver, Challenges, Opportunities and Forecast

Telecommunications – More than Just Talk-time, Challenges, Opportunities and Outlook

Transportation – Better Transport to Boost Economic Growth, Challenges, Opportunities and Outlook

In the next blog post discussing Myanmar’s services sector, we will be looking at the Education sector.

This will be published on 15 November 2017. Stay tuned.