Sectors we have covered:

Hotels and Tourism Part I – Tourism: an Economic Generator & Infrastructure Constraints

Hotels and Tourism Part II – Opportunities, Government Support & Outlook

Banking and Finance – The Economic Driver, Challenges, Opportunities and Forecast

Transportation – Better Transport to Boost Economic Growth, Challenges, Opportunities and Outlook

Retail – Myanmar’s Economy Fueling the Retail Boom, Challenges, Opportunities and Outlook

A Look into Myanmar's Services Sector: Telecommunication

Previously the country’s military regime have hindered further development of its economy, but that is fast changing as Myanmar continues to invite and welcome more foreign direct investments in its pursuit to accelerate the development of its various sectors in the economy. This is important as Myanmar plays catch up with its neighbors in the region so as to remain competitive and relevant to the business community.

Telecommunications – More than just Talk-time

This post will discuss the country’s telecommunications sector. With the approval for Norway’s Telenor Group and Qatar’s Ooredoo in June 2013 to commence operations, this has spur further developments in Myanmar’s telecommunications infrastructure. Back then, the country’s telecommunications’ sector was dominated and monopolized by Myanmar Post and Telecommunication (MPT). Just last month on 14th January 2017, Vietnam’s largest mobile network operator; Viettel was granted the license to operate as Myanmar's fourth telecom operator.

As of the 2nd quarter of 2016, MPT led the country’s telecom market with 20 million subscribers, while Telenor recorded 16.9 million subscribers and Ooredoo with 8 million. In February 2017, MPT has more than 23 million users nationwide.

Viettel, together with a consortium of 11 local firms and a subsidiary of Myanmar Economic Corporation (MEC) make up Mytel; Myanmar’s fourth operator. Mytel, will be concentrating on extending their coverage in rural areas which is about 70 per cent of the country’s population.

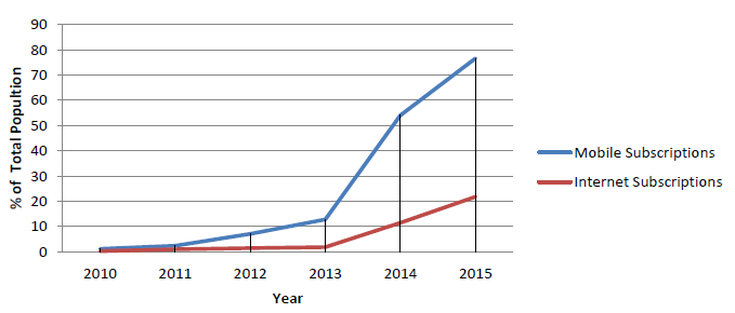

Creating more foreign investment opportunities in the telecommunications sector is pivotal for the country’s socio-economic development. As shown in the chart below, since 2013, both mobile and internet subscription rates experienced significant growth, more so for mobile

- Over 90% of Myanmar population covered by a telecommunication network

- Over 85% of Myanmar population covered by a network that provides internet access

- Over 50% of Myanmar population with access to a high-speed internet connection

Challenges

The significant challenge that the mobile network operators faced is the lack of infrastructure. The sky-rocketing land prices and the lengthy process for building telecommunication towers obstruct the improvements needed to enhance the telecom network and infrastructure. Operators have resorted to sharing towers and fiber cables as it was the only option to remain efficient and keep cost down.

Apart from infrastructure constraints, telecommunication service providers are not just competing on price but also on non-price factors in order to gain a larger market share and meet demand. However, uninterrupted and faster bandwidth internet speed remains a constraints for most service providers.

Opportunities

The telecommunication sector have accounted for a higher percentage of GDP year on year. Together with increasing demand in the consumer market for better telecommunication services, investors may reap the fruits with lower trade-off between risk and return.

The Government of Myanmar fully supports the development of the telecommunication sector and as it provides employment opportunities and technical assistance to the locals. Besides, it may help small local firms by providing outsourcing and subcontracting projects.

Outlook

The development of the telecommunication sector and its impact on socioeconomic status manifest the great potential of a country's economy.

Myanmar have been encouraging rapid market expansion of a range of industries and welcomes the telecommunication operators since 2013. It is only natural for investors to face challenges but the opportunities outbalance these drawbacks to develop productive investment opportunities.

----------

Editor’s Note: For those who have missed out on the other services sectors, click below to read:

Hotels and Tourism Part I – Tourism: an Economic Generator & Infrastructure Constraints

Hotels and Tourism Part II – Opportunities, Government Support & Outlook

Banking and Finance – The Economic Driver, Challenges, Opportunities and Forecast

Transportation – Better Transport to Boost Economic Growth, Challenges, Opportunities and Outlook

Retail – Myanmar’s Economy Fueling the Retail Boom, Challenges, Opportunities and Outlook

In the next blog post discussing Myanmar’s services sector, we will be looking at the Transportation sector. Click here to read