Did You Know?

It is stated under the Constitution that Singapore is required to keep a balance budget over each term of the Government. This island state, unlike many other countries, does not borrow money to fund government expenditure, and the Government does not have any external debt. This practise of fiscal discipline ensures that government funds are utilised wisely towards Singapore’s development across all sectors.

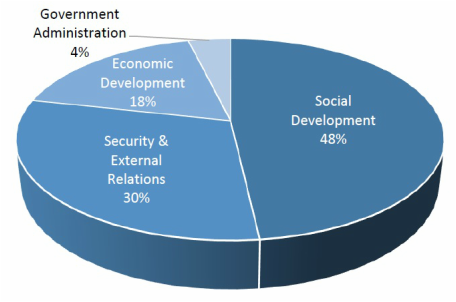

Based on the sectorial breakdown of Government spending in Financial Year 2014, total expenditure by the Government is around 14 - 15% of Gross Domestic Product (GDP), with Social Development accounting for the largest share of Government expenditures. The expenditure estimates do not include spending from Government Endowment and Trust Funds.

Just before the Government draws up the Budget, the Ministry of Finance launched its public consultation process to gather feedback for the next financial year. Individuals, households and businesses are welcome to provide their feedback, suggestions and recommendations on how the Government can best develop Singapore and especially help companies grow through innovation and internationalization.

All suggestions and recommendations submitted during the feedback period are taken into consideration in the drafting of the Budget, before it gets presented officially to the Cabinet for approval. Click here to find out more on some of the recommendations already made by business federations and organizations for Budget 2016.

-----

As most businesses are preparing themselves to face economic uncertainties, shrinking revenue and lower profit margins, many analysts are looking at how the Government aims to continue making Singapore’s market attractive for foreign investments, at the same time spur productivity and innovation amongst local businesses. In addition, these local businesses are anticipating updates to existing assistance schemes or new ones that will benefit them to move towards a value-creating economy.