Under 2019 UTL, the government introduced a tax amnesty for Myanmar citizens with undisclosed sources of income, which is set to expire on 30 September 2020. One of the key highlights of UTL 2020, is the increased tax rates for such undisclosed income to ease the impact on businesses caused by the COVID-19 pandemic. 2020 UTL also outlines the changes with regard to the tax exemption list for commercial tax.

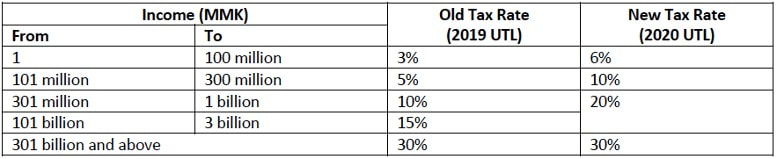

Tax increases for undisclosed sources of income

Under 2020 UTL, there is an increase in tax rates for undisclosed sources of income for Myanmar citizens who cannot show evidence of the sources of income used for purchasing and/or constructing any assets and establish a new business. Refer to the table below for a comparison of the tax rates.

Changes to commercial tax (“CT”)

The CT rate for general goods and services remain at 5% under the 2020 UTL. But the following categories of goods and services are being exempted, the other goods and services remain the same as per 2019 UTL. All together there are 43 types of goods and 33 types of services that are exempted from CT.

Goods

CT is now exempted on soymilk, however other non-dairy products and creamers are subjected to CT. 2020 UTL also highlighted that goods purchased locally or imported under the name of UN organizations are exempted.

Services

Under 2020 UTL, services procured locally under the name of UN organizations that are residents of Myanmar are exempted from CT. Air transport services’ fees to the passengers for domestic and foreign trips are also exempted from CT

Changes to specific goods tax’s tax (“SGT”) tiers and rates

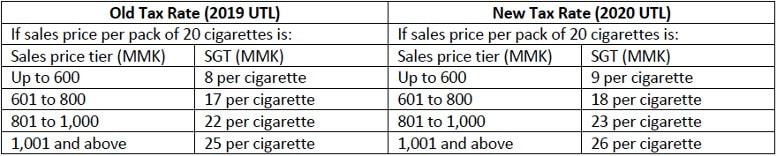

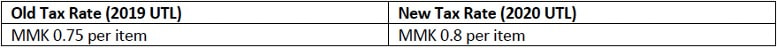

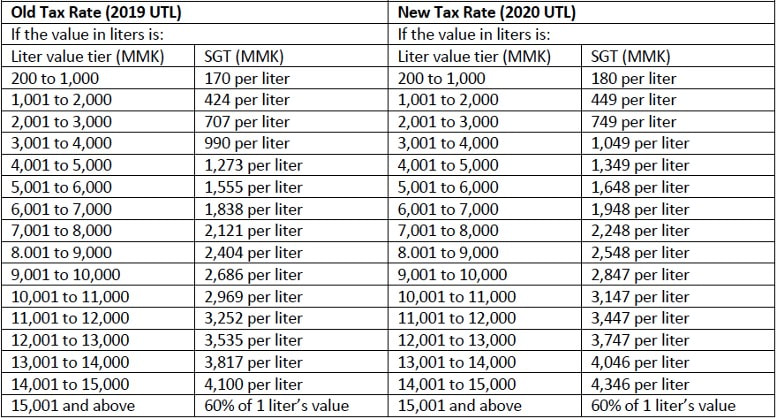

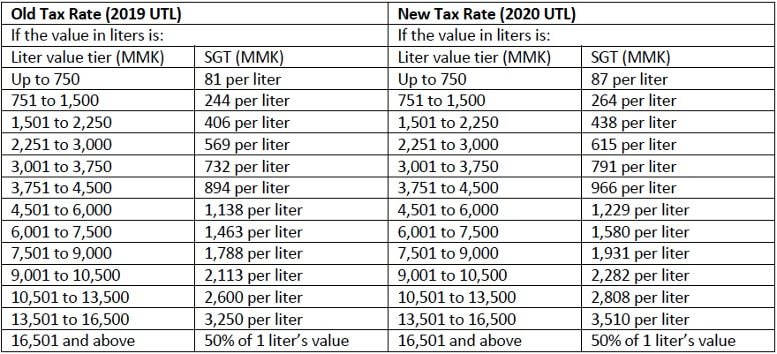

2020 UTL increased the SGT rates for the following goods: Refer to the table below for a comparison of the tax rates.

Cigarettes

Changes to gem stone tax

Gem stone tax remain the same as per 2019 UTL. The rates range from 5% to 11% (depending on the type of gemstone).

How Inter Group can help you?

If you have any questions on the above-mentioned topic or unsure how the changes might affect you and your business, do not hesitate to contact us to assist you, so that you remain compliant with the new law.