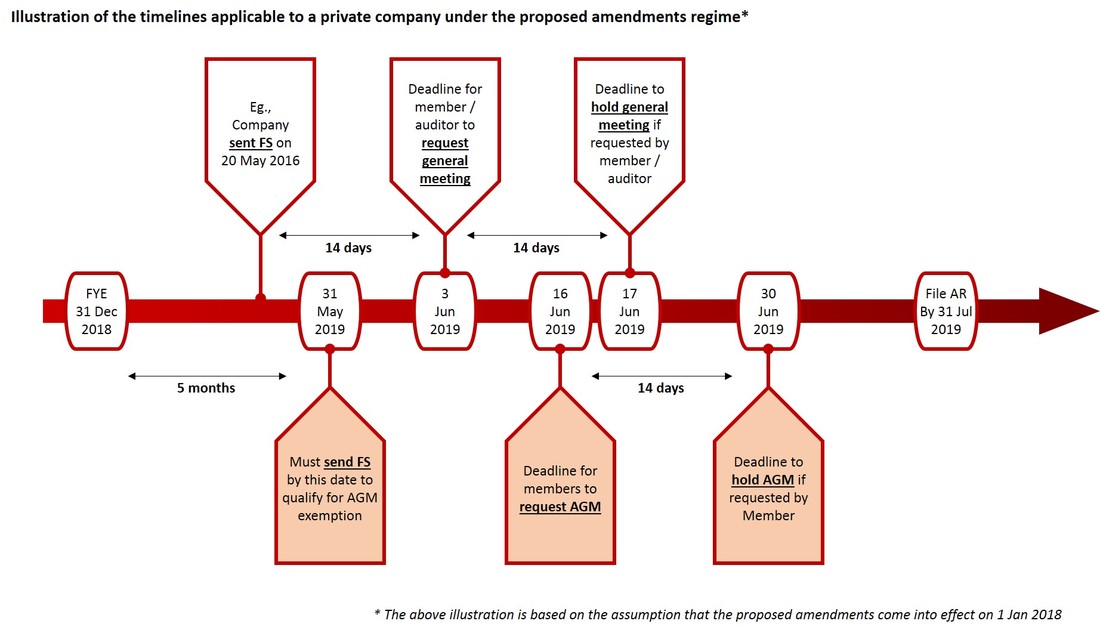

Aligning corporate compliance timelines to the Financial Year End (FYE). The timelines for holding Annual General Meetings (AGMs) and Annual Returns (AR) filing will be aligned with the company’s FYE. This will provide a greater clarity and improve the companies’ compliance requirements as stated in the Companies Act.

Current |

From first half of 2018 |

Holding of AGMs |

Holding of AGMs |

(a) Timeline 1: Hold first AGM within 18 months, and subsequent AGMs yearly at intervals no longer than 15 months |

For listed companies - Hold AGM within 4 months after FYE |

(b) Timeline 2: Financial statements tabled at AGM must be made up to a date within 4 months (for listed company) or 6 months (for any other company) before the AGM date |

For any other companies - Hold AGM within 6 months after FYE |

Filing of Annual Returns |

Filing of Annual Returns |

For companies having a share capital and keeping a branch register outside Singapore - File annual returns within 60 days after AGM |

For companies having a share capital and keeping a branch register outside Singapore - File annual returns within 6 months (if listed) or 8 months (if not listed) after FYE |

For other companies - File annual returns within 30 days after AGM |

For other companies - File annual returns within 5 months (if listed) or 7 months (if not listed) after FYE |

- |

Annual returns can only be filed: - after an AGM has been held - after financial statements is sent if company need not hold AGM; or - after FYE for private dormant relevant company that is exempted from preparing financial statements |

- Companies must notify the Registrar of the FYE upon incorporation and of any subsequent change;

- Companies must apply to the Registrar for approval to change their FYE:

- If the change in FYE will result in a financial year longer than 18 months or;

- If the FYE was changed within the last 5 years;

- Only FYE of the current and immediate financial year (provided that the statutory deadlines for the holding of AGM, filing of annual returns and sending of financial statements have not passed) may be changed; and

- Unless with approval from the Registrar, the duration of a company’s financial year must not be more than 18 months in the year of incorporation.

- Companies with odd financial year period (not 12 months) must notify ACRA if they want to avoid applying for approval to change FYE every year.

- Existing companies will have their FYE deemed by law to be any date as previously notified to the Registrar. In the absence of such notification, the anniversary of the incorporation date will be deemed by law to be the company’s FYE. Companies can change their FYE by notifying ACRA.

Not sure how this affects you?

Contact our consultants today. Inter Group can help you!

Inter Group provides corporate compliance solutions to meet your business needs. Our competent pool of corporate secretaries and consultants possess a wealth of experience – they will be able advice you on your needs and address any queries you may have. We also ensure that our clients are duly informed of timely advises and are kept abreast with latest statutory and compliance updates. For a customised assessment of your taxes, call us +65 6336 9912 or email us at [email protected] today.